How to Build a Long Term Watchlist Using ChatGPT

If you’re serious about building wealth, you need more than hot tips from Reddit or TikTok. You need a personalized stock watchlist that reflects your goals, risk tolerance, and timeline. And thanks to AI tools like ChatGPT, you can now build one smarter—and faster—than ever. Below I list some steps on how to get started.

Step 1: Define Your Investor Identity

Before building a watchlist, get clear on who you are as an investor. Are you focused on long-term growth? Steady dividend income? Undervalued value plays? Or maybe a mix of all three?

Knowing your investing style will shape the kind of stocks (or ETFs) you should be watching. This is your foundation—don’t skip it.

➡️ Want help identifying your style? Read this guide on crafting your investor identity

Step 2: Use ChatGPT to Generate Stock Ideas

Once you’ve defined your goals, open ChatGPT and start with a role-based prompt like:

“Act as a long-term investor with 30 years of experience. Based on current market trends, suggest 5 U.S. stocks and/or ETFs with strong fundamentals, good long-term growth potential, and a track record of profitability.”

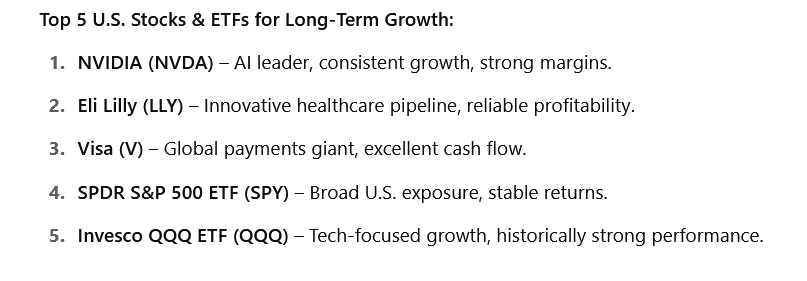

Here’s what it came up with

I can’t argue with these results, this is a great starting point. Want dividend picks? Small caps? International exposure instead? Just tweak the prompt to match your needs.

Step 3: Filter Your List

ChatGPT’s recommendations are just the starting point. Go deeper:

- Ask for valuation metrics (P/E, PEG, P/B)

- Review historical performance

- Cross-check sectors to avoid over-concentration

Here are some example prompts (from my eBook) to take your analysis further—just replace the company name with one from your list:

- What does NVIDIA’s price to earnings ratio indicate about its valuation compared to the industry average?

- Analyze Microsoft’s revenue growth and price trends to identify a good entry point.

- Compare Walmart’s net income in 2023 vs 2024 and explain the trend.

Understanding metrics like these gives you insight into whether a company is financially sound and potentially worth investing in.

Step 4: Organize and Track

Once you’ve built your watchlist, stay organized. Use Google Sheets or Notion to track items such as:

- Stock name

- P/E ratio

- EPS

- Current price

- Target buy price

You can even ask ChatGPT to help build this for you and paste its outputs directly into your spreadsheet:

“Please create and provide an Excel file or spreadsheet containing your recommended stocks with columns for Ticker, Company, Current Price, Buy Price, P/E Ratio, D/E Ratio, EPS, and Notes, so I can directly upload it.”

Step 5: Review and Update Regularly

Markets change. Companies evolve. And in today’s economic climate—with tariffs, interest rate shifts, and global uncertainty—it’s even more important to stay up to date.

Set a monthly reminder to revisit your list and re-run your ChatGPT prompt to refresh your ideas or remove stocks that no longer fit.

Built a watchlist—now what?

Download my Ultimate Guide to Buying Your First Stock and learn how to confidently take action on the names you’ve added to your list.