The Best Way to Build Generational Wealth for Kids? A Custodial Account

When I think about the best financial gifts I can give my kids, it’s not toys, clothes, or even a college savings plan. It’s ownership. That’s why I believe a custodial account is one of the smartest ways to set them up for success.

It’s simple, powerful, and most importantly it teaches them about money and investing at an early age so it becomes part of their foundation.

What is a Custodial Account?

A custodial account is an investment account you open for a minor. It falls under either the UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act), depending on your state.

Here’s why it matters:

- You control the account until your child reaches the legal age (usually 18 or 21).

- The money is legally theirs and can be invested in stocks, ETFs, or mutual funds.

- It’s a tool for generational wealth, letting kids grow up with both assets and financial literacy.

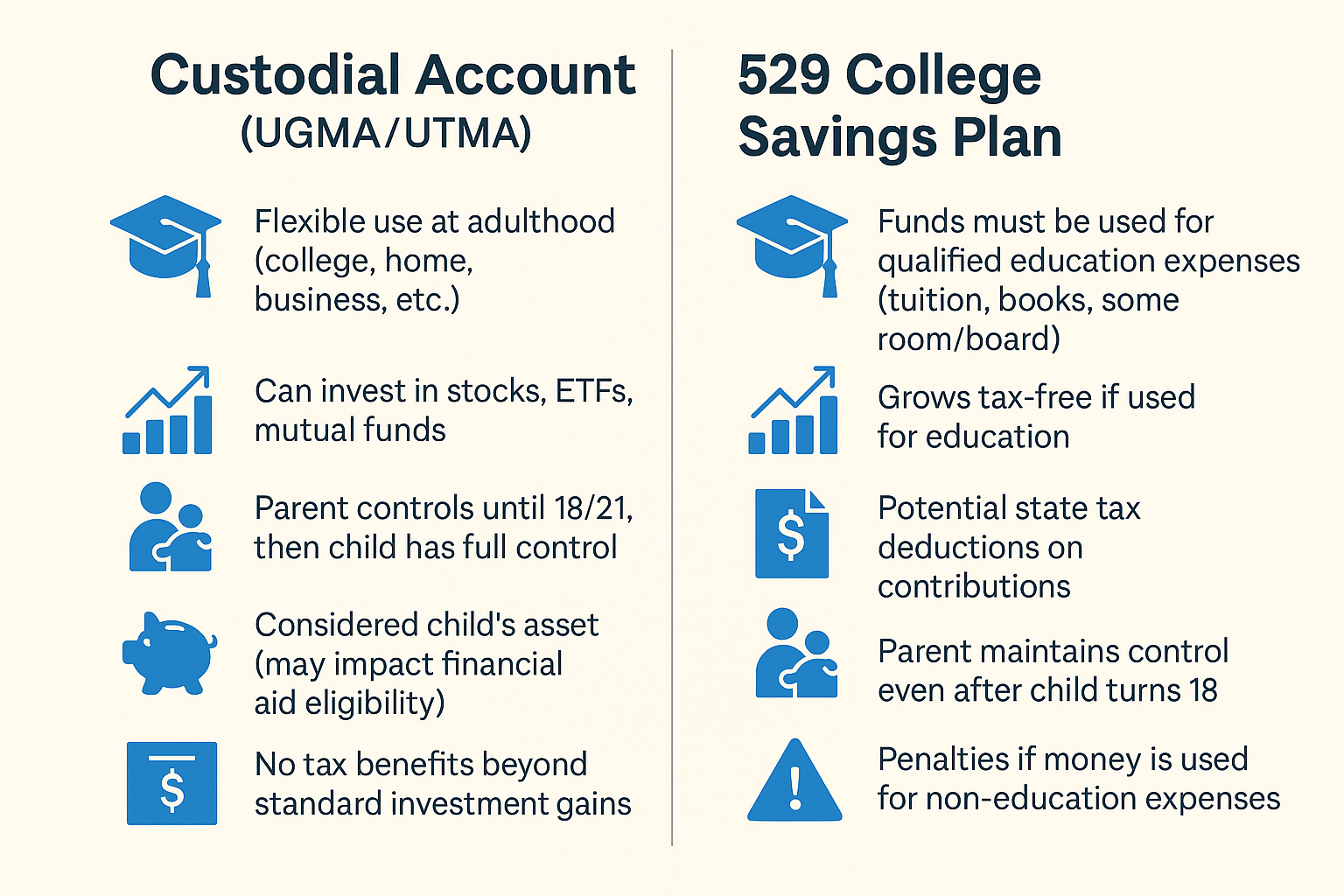

Unlike a 529 college savings plan, custodial accounts are flexible. A 529 can only be used for qualified education expenses but custodial funds can be used for anything once your child is of age. That could mean tuition, a first home, or even seed money for a business. You’re not locking them into just one path.

How to Open One

Opening a custodial account is almost identical to opening a standard brokerage account:

- Choose a broker. Fidelity, Vanguard, and Charles Schwab all offer custodial accounts with low fees and easy online setups.

- Fund it. Transfer money directly or set up automatic contributions. Even $25 a month adds up over time.

- Pick investments. For most families, ETFs or index funds are a safe, diversified starting point.

- Monitor lightly. This is long term money. No need to day-trade your kid’s future.

What Should You Invest In?

There’s no reason to over-complicate things. I treat my kids’ custodial accounts like my own portfolio but with an eye toward growth.

- ETFs. Broad market exposure, low cost, long-term growth.

- Strong growth stocks. Since you’re investing for a child, time is on your side. They can ride out downturns and capture decades of upside. Imagine if your parents had bought you 100 shares of Apple at age 5. Today, AI leaders and cybersecurity innovators could be that same generational play.

- Dividend stocks. I use these more for teaching than performance. When a stock pays them just for owning it, it’s an easy way to explain passive income.

How to Get Your Kid(s) Involved

The account itself is valuable, but the real benefit is teaching your kids to care about it.

- Let them help pick a stock or sector. If they love Disney, let them own Disney.

- Show them how to track performance over time. Green days, red days, and everything in between.

- Use it as a teaching tool for saving, patience, and ownership.

By the time they’re grown, they won’t just inherit money. They’ll inherit financial literacy which many of us didn’t have when we were 18.

Final Word

Opening a custodial account isn’t just an investment move. It’s planting seeds of wealth and knowledge your kids can build on for decades.

👉 Want more ways to raise financially savvy kids? Check out my article How I Got My 5-Year-Old to Love Investing and subscribe below for more practical strategies on building generational wealth.