We Tested 3 Top AIs for Investing—Here’s the Surprising Winner

AI tools like ChatGPT are quickly reshaping how investors gather, analyze, and act on information.

But with more large language models (LLMs) entering the space, the real question is: which one is actually the most useful for investing and financial research?

To find out, I ran five investing-focused prompts through three of the most popular AI tools available today:

- ChatGPT 4.0 (via ChatGPT Plus)

- Google Gemini 2.0 Flash Thinking

- DeepSeek R1 Base (Free version)

Each model was evaluated not just on the correctness of its answers, but also on how well it communicated insights and summarized financial data.

Also how it followed up, and supported different types of investors—from beginners to more advanced users. Let’s see how they stacked up.

Evaluation Method

To simulate a range of real-world investing scenarios, I gave each model the same set of prompts framed as if I were speaking to a seasoned financial strategist. I set the stage with this initial prompt:

“You are a seasoned portfolio strategist, CFA charterholder, and equity analyst with over 20 years of experience helping clients build wealth through long-term investing.

You specialize in stock analysis, portfolio construction, scenario planning, and simplifying complex financial concepts for investors of all levels.” (use quote feature in wordpress)

Then I tested five prompts, each targeting a different area of financial support. Responses were scored out of 5 based on:

- Relevance & clarity

- Depth of analysis

- Use of data or metrics

- Practicality and insight.

| Prompt | Category |

|---|---|

| Index Funds & ETFs | Beginner Investor Education |

| Netflix vs Disney | Fundamental Analysis |

| Tesla Earnings | Financial Reporting |

| Portfolio Review | Portfolio Re-balancing |

| Cybersecurity Picks | Stock Discovery |

Below I breakout how each model performed, starting with a foundational topic every investor should understand index funds.

Prompt Breakdown: How Each Model Performed

🧠 Prompt 1: Explain Index Funds + Compare VOO vs QQQ

| Metric | VOO (S&P 500) | QQQ (Nasdaq-100) |

|---|---|---|

| Index Tracked | S&P 500 (Large-cap U.S.) | Nasdaq-100 (Tech-heavy) |

| Top Holdings | Apple, Microsoft, Amazon | Apple, Microsoft, Nvidia |

| Sector Weight | Broad, diversified | Heavily weighted in tech |

| Expense Ratio | 0.03% | 0.20% |

| 10-Year Avg Annual Return | ~12% | ~17% |

| Volatility (Std Dev) | Lower (~15%) | Higher (~22%) |

| Dividend Yield | ~1.5% | ~0.6% |

| Risk Level | Moderate | Higher risk, higher reward |

What I Asked:

“Explain how index funds work and why they’re a good option for beginner investors. Compare VOO and QQQ in terms of historical returns and risk.”

Summary:

All three models handled the index fund explanation well, giving beginner-friendly overviews of what index funds are and why they’re useful.

But each one had its own strengths—and weaknesses—when it came to comparing VOO vs. QQQ.

- ChatGPT stood out with a clear, beginner-friendly explanation and created a helpful table comparing VOO & QQQ.

- What made it feel like more than just a tool? It followed up with, “Would you like a portfolio model using VOO and QQQ?”—like a real assistant anticipating your next move.

- Gemini delivered a strong foundational explanation of what index funds are and why they’re a good option for new investors.

- Its comparison of VOO and QQQ lacked key metrics like historical returns, without those, the answer felt more like a general overview than a decision making tool.

- DeepSeek gave the cleanest side-by-side breakdown of VOO vs. QQQ in a clear visual format.

- Its explanation of index funds lacked depth and assumed some prior knowledge, which is less ideal for beginners.

Scorecard:

ChatGPT:5/5, Gemini:4/5, DeepSeek: 4.5/5

| ChatGPT: 5/5 | Gemini: 4/5 | DeepSeek: 4.5/5 |

🎬 Prompt 2: Netflix vs. Disney – Financials, Strategy, and Long-Term Potential

What I Asked:

“Compare Netflix and Disney in terms of revenue growth, content strategy, and international expansion over the last 3 years. Recommend which may offer better long-term potential and why.”

Summary:

All three models delivered useful comparisons, but each leaned into different strengths—ChatGPT blended strategy and financials well, Gemini lacked key data, and DeepSeek nailed the numbers but felt lighter on narrative. This prompt highlighted how differently each tool approaches depth and clarity.

- ChatGPT delivered the most well-rounded response—clearly laying out each company’s strengths, like Disney’s parks and merchandise vs. Netflix’s content-heavy strategy. It backed that up with solid revenue insight and picked Netflix as the stronger streaming play, while still giving Disney credit for its broader appeal. A visual comparison of the two would’ve made the response even stronger.

- Gemini did a good job covering both companies’ content strategies and international growth, but it skipped over key financial metrics. Its take on the numbers felt vague, which weakened the comparison. It chose Disney for its diversified business model but didn’t really build a strong case for why it was the better long-term play.

- DeepSeek nailed the financials with a clean chart comparing three years of revenue, margins, and debt. Its commentary on strategy was a bit light, and while it also backed Disney, the rationale wasn’t as persuasive as ChatGPT’s. Still, for visual learners, DeepSeek delivered—and I’ll admit, I’m a sucker for a great comparison table.

Scorecard:

| ChatGPT: 4.5/5 | Gemini: 3.5/5 | DeepSeek :4/5 |

📊 Prompt 3: Tesla Quarterly Earnings Recap

What I Asked:

“Summarize the most important takeaways from Tesla’s most recent quarterly earnings. Include revenue, net income, guidance, and management commentary.”

Summary:

All three models handled the Tesla earnings recap well, but Gemini stood out thanks to real-time search. It pulled the latest numbers and key management quotes, giving it an edge in a news-driven prompt.

- ChatGPT delivered exactly what I asked for—a clean, well-organized summary of revenue, net income, and EPS, along with a balanced read on what worked and what didn’t in the quarter. It also included context from management’s guidance, making the recap feel complete and investor-ready.

- Gemini stood out thanks to its real-time Google search. It pulled fresh earnings data, included accurate numbers, and added direct commentary on margins and vehicle deliveries. This is where Gemini’s live data edge really shows and I’d love to see more of that across other use cases.

- DeepSeek was solid but lagged a bit behind. It shared the numbers in its usual bullet-point format, but barely touched on management commentary. This tends to be a common theme in my experience with DeepSeek—it often nails the numbers, but sometimes lacks the nuance and context that investors look for.

Scorecard:

| ChatGPT: 5/5 | Gemini: 5/5 | DeepSeek :4/5 |

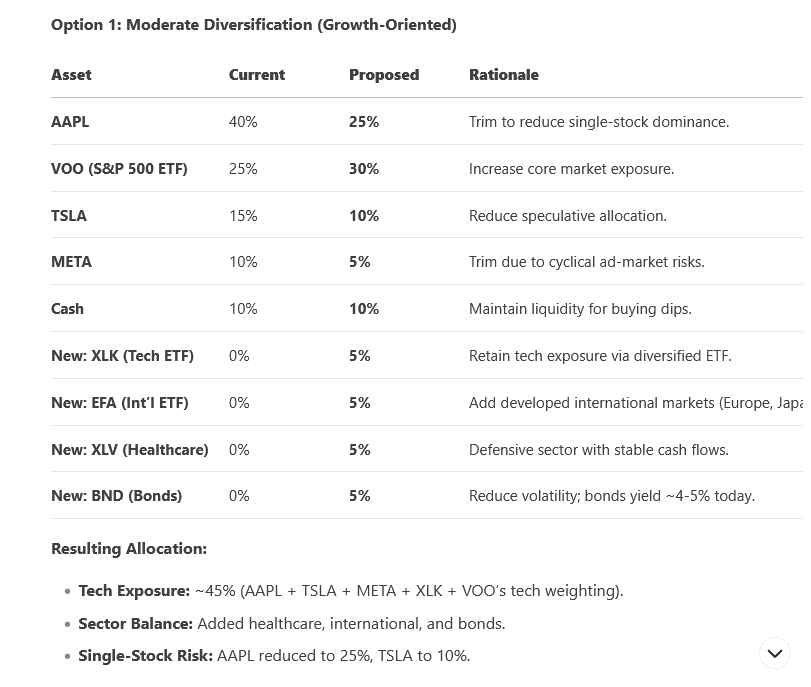

💼 Prompt 4: Portfolio Re-balancing

What I Asked:

“Review this portfolio: 40% AAPL, 25% VOO, 15% TSLA, 10% META, 10% cash. Suggest re-balancing options to improve diversification and reduce sector risk

Summary:

All three LLMs recognized that this portfolio is overweight in Apple and technology as a whole and each offered solid strategies to rebalance the portfolio but they diverged in how detailed they got.

- ChatGPT gave a solid, straightforward take. It flagged the tech concentration risk and suggested a more balanced allocation. The advice was smart and clear, but it didn’t go as deep as the others—no scenario comparisons or sector-level diversification plans.

- Gemini really shined here. It laid out three distinct re-balancing paths—conservative, moderate, and aggressive—along with rationale and sector ETF ideas. This made it easy to match the advice to my risk tolerance, and the structure felt like advice from a real strategist.

- DeepSeek also performed well. It provided reallocation percentages, specific ETF and stock suggestions, and both standard and aggressive options. It wasn’t as conversational, but the analysis was detailed, sharp, and highly usable.

Scorecard:

| ChatGPT: 4/5 | Gemini: 5/5 | DeepSeek: 4.5/5 |

🔐 Prompt 5: Cybersecurity Stock Picks

What I Asked:

“Suggest 3 long-term growth stocks in the cybersecurity sector with strong fundamentals, low debt, and consistent earnings. Briefly explain why each is a promising investment.”

Summary:

All three LLMs identified the same three names—CrowdStrike, Palo Alto Networks, and Fortinet—which shows strong alignment on the sector’s top players. But the way each model presented its case was very different.

- ChatGPT delivered the delivered the most thoughtful and complete response. It built a comparison table and clearly laid out why CrowdStrike stood out-citing strong revenue growth, profitability, and market position. It felt like a well-informed recommendation aimed at real investors.

- Gemini stumbled out of the gate with a disclaimer, but once I reframed the prompt as “educational,” it came through. The stock picks were solid, and the rationale made sense, but it lacked financial data and comparisons—making it feel more like general advice than a researched opinion. It chose Palto Alto as the best investment.

- DeepSeek kept things tight and to the point. It explained each pick clearly and, like GPT, chose CrowdStrike as the best of the three. The format was more checklist than narrative, but it hit all the key points and delivered a useful answer.

Scorecard:

| ChatGPT: 5/5 | Gemini: 3/5 | DeepSeek: 4.5/5 |

After running all five prompts, the differences became even clearer—each model brought something to the table, but only one consistently delivered across the board. Below is the final scorecard and a quick guide to which type of user each model fits best.

🏆 Final Verdict: Which AI Model Should You Use?

| Model | Score | Best For |

|---|---|---|

| ChatGPT | 23.5/25 | Most well-rounded. Great for strategy + education. |

| DeepSeek | 22/25 | Data-first thinkers who want clarity + structure. |

| Gemini | 20.5/25 | Beginners who want solid frameworks and coaching. |

While all three have their strengths, ChatGPT edged out the win for its blend of strategic thinking, ease of use, and smart follow-ups that made it feel like a true investing assistant. DeepSeek was a pleasant surprise providing clean visuals and reliable data. Gemini is a great on-ramp for newer users looking for simple explanations and macro-level guidance.

💡 Pro Tip: You don’t need to pick just one. Each tool brings something different to the table. Try them side-by-side like I did, and let your investing style guide which becomes your go-to..

Ready to see what AI can do for your investing strategy?

Download my free guide: How to Invest with ChatGPT — and subscribe for updates on AI tools, smart prompts, and weekly breakdowns designed for investors at every level.