My Weekly Investing Prep with ChatGPT: News, Earnings, Portfolio & More

If you’re serious about staying sharp as an investor, preparation is key.

Once my three year old stops coming down the stairs trying to skip bed time, I turn Sunday evening into my secret weapon. A quick, focused 30 minute routine that gets me mentally and strategically ready for the week. And thanks to AI tools like ChatGPT the whole process runs faster and smoother.

Here’s my full Sunday investing routine, step by step:

Step 1: Review the Past Week

I kick things off by asking ChatGPT:

“What were the top-performing and worst-performing sectors and stocks in the S&P 500 last week?” This helps me spot early trends or anomalies. I’ll often cross-check with a finviz performance map to verify and for a visual snapshot.

Then I ask:

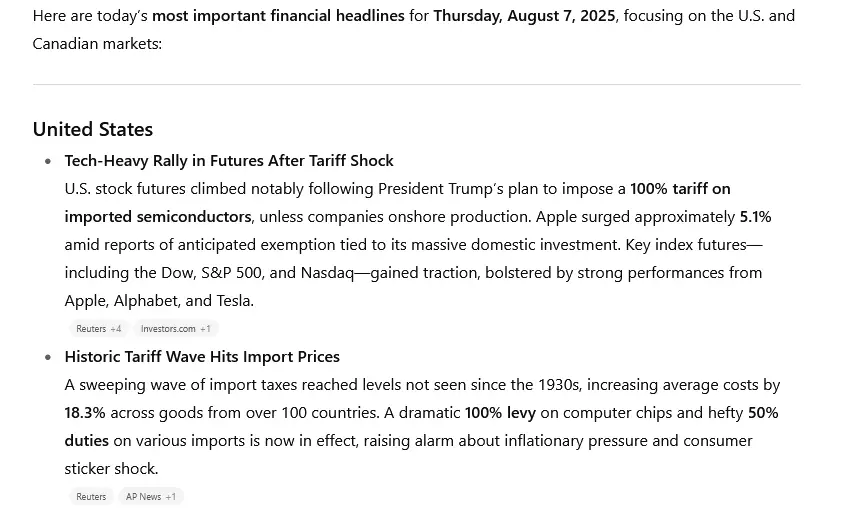

“What was the biggest financial news of the week?”

Instead of endlessly scrolling through headlines, I get a clean curated summary in seconds. If something stands out, I can then dive deeper into the news that actually matters to me.

Bonus Tip:

If you’re using ChatGPT Plus, you can create recurring tasks to automate this. I have daily and weekly prompts saved that deliver market summaries and top headlines automatically. The below screenshot is an example.

Step 2: Check Upcoming Events

After reviewing the past week, I focus on upcoming events and ask ChatGPT:

“Act as a financial market analyst. For the week of [insert date range], list the most important earnings reports and economic events in the U.S. Include inflation data, fed meetings, jobs reports, and any major company earnings. Provide a short summary for each and note any events that could move the market.”

This gives me an edge for timing moves like options plays or trimming positions, no more scrambling mid-week to figure out what’s happening.

Step 3: Analyze My Portfolio & Watchlist

I don’t do a full deep-dive every Sunday, but if I’ve been eyeing a few companies or want to reassess part of my portfolio, I’ll run a quick check with prompts like:

Give me a quick health check on [Company Name]: recent earnings, major news, and any red flags.”

For my watchlist stocks, I ask:

“Act as a seasoned investment analyst. Evaluate [Company Name] for long-term growth potential and current valuation. Include key financial metrics, recent performance trends, competitive positioning, and any notable risks or red flags investors should be aware of.“

Step 4: Finalize My Game Plan

I wrap up by noting a few key takeaways:

- 1–2 stocks I may want to add to my portfolio

- Potential stocks to sell or re-position

- Options strategies worth exploring

- Red flags or earnings dates to watch

- Macro or market narratives to monitor

By the time Monday rolls around, I’ve got a clear mental picture and AI makes that plan sharper and faster to execute.

Want smarter money moves in your inbox?

I send out 1–2 quick reads per week on how to use AI for investing, build wealth on your terms, and stay ready even when life’s busy. Subscribe below and receive your free guide on how to use ChatGPT to invest.

And stay tuned: I’m dropping two powerful prompt packs soon that will take your investing game to the next level, whether you’re just getting started or ready to go pro.