This Simple AI Hack Makes Financial Reports Easy

We all know financial reports are important but keep it one hundred (100), how many of us actually read them? If you’ve ever opened a company’s annual report or 10-K, you know the feeling: instant dread. 200+ pages of charts, footnotes, and legal jargon dense enough to make even seasoned investors want to quit.

But here’s the thing: you don’t need to read every single page to understand a company’s financial health. Thanks to AI, you can cut through the noise and extract the key insights in minutes instead of hours.

Why Financial Reports Matter

Financial reports tell you everything: how the company makes money, whether it’s growing or stalling, what risks are lurking, and where management thinks it’s headed. That information is sitting right there in plain sight. Ignoring it means you’re investing blind, basically turning the stock market into a scratch-off ticket. Learn to extract the key points, and you’ll invest with confidence instead of hope.

How I use AI to do the Heavy Lifting

Here’s where AI changes everything. Instead of slogging through every page, I upload the report into a tool like ChatGPT and use prompts to zero in on what matters most. No finance degree required. No all-nighters. Just the insights I need in a fraction of the time.

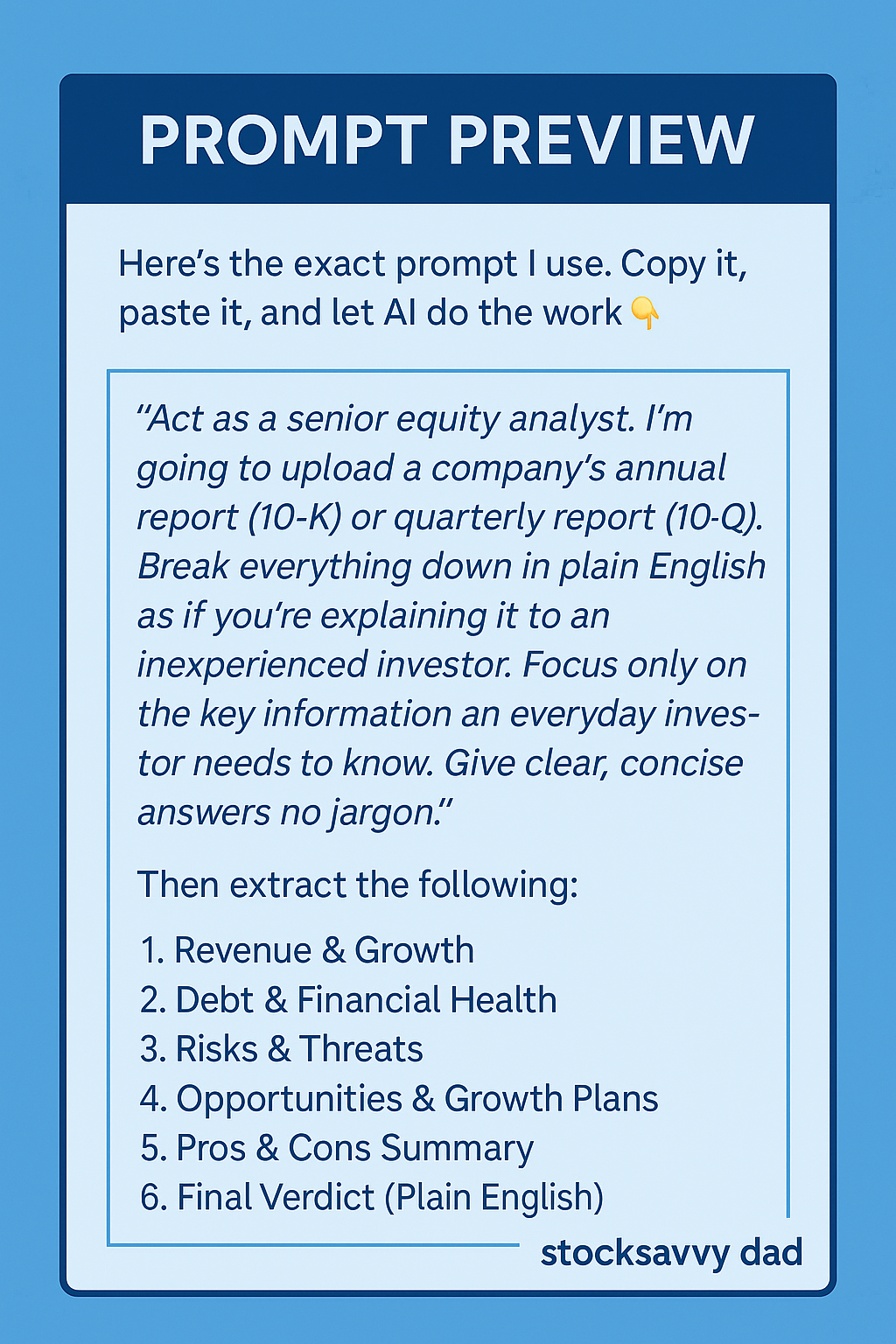

Here’s my exact process:

- Upload the file (annual report, 10-Q, or 10-K.)

- Ask AI to summarize key sections: revenue, debt, risks, growth plans.

- Get a quick pros/cons breakdown so I know if it’s worth digging deeper.

After uploading a report, I ask AI to do the following:

- Summarize the company’s revenue growth and key financial metrics over the last 3 years.

- List the biggest risks and threats the company faces

- Explain company debt levels and whether they look manageable.

- Analyze new opportunities or growth plans in the pipeline.

Below is an example prompt that you can use and click here to view a reel of me putting it into action.

What You Should Still Do Yourself

AI is powerful, but it’s not a fortune teller. Here’s what still requires your eyes and judgment:

- Check the numbers. AI summarizes trends, but you still need to verify the actual revenue, profit, and debt figures.

- Understand the story. A profit dip might look bad until you realize it’s reinvestment in future growth. Context matters.

- Compare competitors. Always benchmark against peers in the same industry to see how the company stacks up.

Final Word

Financial reports don’t have to be overwhelming. With AI, you can cut through the noise, extract what matters, and make smarter decisions in minutes, not hours. No MBA required.

Want the exact prompts I use? Download my Savvy Investor AI Toolkit and start analyzing companies like a pro.