How to Get an 800 Credit Score

My Story

About 15 years ago, in my early 20s, I took my first leap into the world of credit with an Amazon rewards Visa card. Enticed by the checkout bonus, I felt a rush of adrenaline as I purchased with borrowed money. While I didn’t initially overspend, my understanding of credit was limited. I wasn’t always paying off my balance in full each month and soon realized how much money I was wasting on interest. That’s when I made a promise to myself to never pay a cent of credit card interest again.

My credit score remained intact due to my on-time payments, but it wasn’t long before a falsely reported $8 medical bill sent it tumbling. Eight dollars? You can’t even buy a beer for $8 these days. Anyway, monitoring my credit regularly, I noticed the sudden dip below 600 and felt confused, thinking I was doing everything right. I requested a credit report, spotted the erroneous charge, disputed it with the credit bureau, and boom- it was removed. In a month or so, my credit score rebounded to around 680.

Fast forward to today, I proudly boast a credit score between 800-820. It wasn’t an easy climb, but every step was a lesson learned. Now, I’m here to share these insights with you. Regardless of your stance on the credit system (there’s a lot of BS) there’s undeniable value in properly leveraging it, from earning rewards to enhancing financial security. So, let’s dive in, and I’ll show you exactly how to get your credit score climbing.

What is a credit score?

A credit score is a numerical representation of your creditworthiness, based on your credit history. It’s like a financial report card that lenders, landlords, and sometimes employers use to assess your reliability to pay back the money that you’ve borrowed. Having a good credit score offers numerous benefits – it can unlock access to better loan terms, lower interest rates, and even increase your chances of landing that dream job or apartment.

Understanding & Navigating Your Credit Score

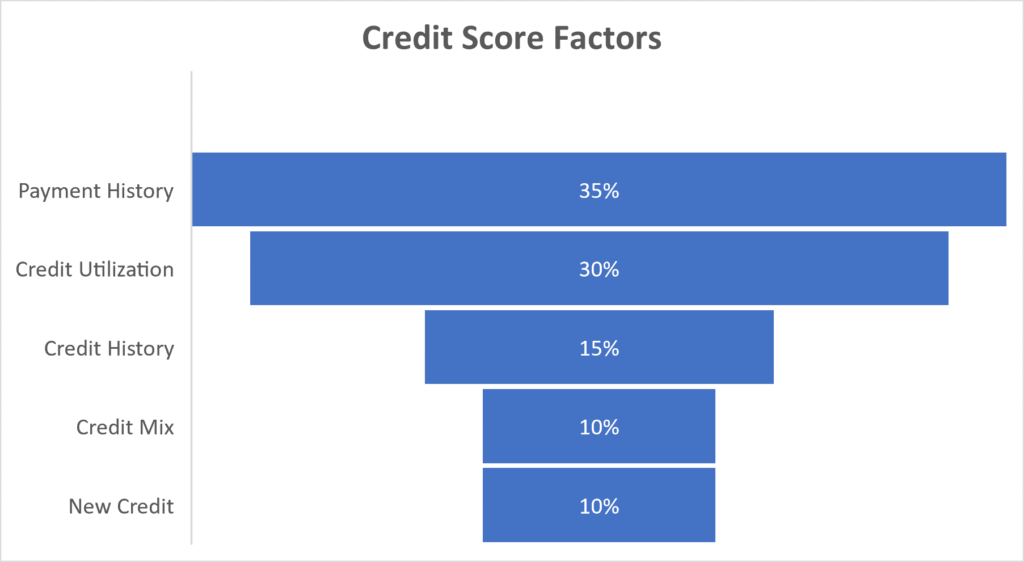

To have an excellent credit score, you first need to understand the elements that shape it. Let’s dive into these aspects and their importance, complemented by some personal insights:

Payment History (35% of your score): This is the largest component of your credit score. It tracks whether you’ve paid past credit accounts on time. Even a single late payment can harm your score.

What to Do: Plain and simple, Pay off your balance on time and in full, every time. If this proves challenging, consider reducing your expenses or reevaluating the necessity of that card. With interest rates rising, late or partial payments can become costly. If managing multiple accounts is an issue, leverage tools such as autopay or apps that provide an overview of your monthly expenses. Sound money management is the backbone of a great credit score.

Amounts Owed/Credit Utilization (30%): This refers to the proportion of your available credit that you’re currently using. Ideally, you should aim for a credit utilization rate of 30% or less.

Savvy Dad Tip: The utilization rate can be deceptive. If you have a single card with a $5,000 limit and spend $2,500 monthly, your credit utilization is 50%, beyond the suggested rate. In contrast, someone spending $25,000 across multiple cards with a combined limit of $200,000 has a utilization rate of 12.5%. If high utilization is a recurring issue for you, consider increasing your credit limit or opening a new credit account, assuming your spending remains constant.

Length of Credit History (15%): The longer your credit history, the better it is for your score. It includes the age of your oldest account, the age of your newest account, and the average age of all your accounts.

What to Do: This factor is largely dependent on time. One essential tip is to keep your oldest accounts open for as long as possible. Closing your longest-standing account can drastically reduce your credit history length. That’s why I advocate for your first credit card to be one with no annual fees. You’re less likely to cancel a card that doesn’t charge annual fees, whereas a high-fee card may not deliver enough value to justify keeping it open.

Credit Mix (10%): This factor looks at the types of credit you’re using – credit cards, retail accounts, installment loans, mortgage, etc. A diverse credit portfolio is better for your score.

Savvy Dad Tip: While a diverse credit portfolio can benefit your score, it’s not necessary to rush into obtaining different credit types. Most of my credit is from credit cards, and my score sits around 800.

New Credit (10%): This includes recently opened accounts and credit inquiries. Opening too many new accounts in a short time can signal higher risk to lenders and could hurt your score.

Savvy Dad Tip: New credit applications result in hard inquiries, causing a temporary drop in your score. Try to space out new credit card applications, ideally leaving at least 90 days in between. However, new credit can also improve your credit utilization ratio, as it increases your overall available credit.

Money Management & Strategies to improve your score

In the previous section, we peeled back the layers of what shapes your credit score and provided specific tips on how to manage each component. Now, let’s elevate our discussion to broader strategies that can propel your credit score and overall financial health to new heights.

Set Budgets and Financial Goals: Crystalize your financial goals and craft a budget that aligns your income and expenses. It ensures that you live within your means and meet all financial obligations, including credit repayments. Remember, chasing reward points with money you don’t have can backfire, costing you more in interest than the rewards are worth.

Regular Credit Report Checks: Consistent review of your credit reports helps you grasp your current credit standing and identify any errors. Remember my story about the erroneous medical bill? Regular checks help catch such issues before they can do long-term damage.

Build an Emergency Fund: Life is full of surprises, and not always pleasant ones. An emergency fund can absorb the financial impact of unexpected expenses or sudden income loss. This way, you avoid high credit utilization or missed payments, which could harm your credit score. As a basic financial safety net, aim for at least six months of living expenses – personally, I prefer a year’s worth excluding investments.

Responsibly Increase Credit Limit: If your spending patterns are consistently manageable, you might want to request a credit limit increase. This, if you maintain your spending habits, lowers your credit utilization ratio. For more on this, revisit the section above on credit utilization.

Consider a Secured Credit Card: If you’re new to the credit world or rebuilding your credit, a secured credit card could be an option. These cards require a deposit, which doubles as your credit limit, minimizing the lender’s risk. Regardless, treat it like a standard card – make on-time payments and pay off the balance in full each month.

Debt Consolidation: Managing multiple debts can be like juggling flaming swords. Debt consolidation can simplify this process by rolling your debts into one monthly payment with a potentially lower interest rate.

Final Thoughts: The Journey to an Improved Credit Score

As you embark on or continue your own credit score journey, here are some key takeaways:

- Familiarize yourself with the factors that influence your credit score and use them to your advantage.

- Regularly monitor your credit report to stay informed and promptly address any errors.

- Cultivate financial discipline, spend within your means, and always strive to pay your balance in full and on time.

- Embrace setbacks as opportunities for growth. Use them to learn, adapt, and become more financially resilient.

Remember, enhancing your credit score isn’t an overnight task but a journey requiring patience, discipline, and perseverance. However, the benefits of an excellent credit score – lower interest rates, better loan terms, increased financial security and quite frankly better credit cards – make it worth the effort. Also check out my post on why you need to invest, which I think ties nicely into this.

In a future post, I’ll dive into the topic of reward points and share my top five favorite credit cards. But for now, keep striving, stay diligent, and remember, every step toward improving your credit score is a step toward financial empowerment.