Stop Wasting Points: 5 Rookie Credit Card Mistakes (And How to Fix Them)

stocksavvydad.com Comments 0 Comment

Using credit cards for rewards can be a great way to upgrade your lifestyle without spending thousands on fancy hotels or business class flights. But it only works if you know what you’re doing.

If you’re serious about getting the most out of your cards (and not leaving money on the table) here are five rookie mistakes to avoid and how to fix them.

1. Paying Interest While Chasing Points

If you’re not paying your balance in full each month, those rewards aren’t free, they’re costing you money.

Rookie Mistake: Overspending to hit a bonus, then carrying the balance.

Fix: Only spend what you can afford to pay off. Credit card interest rates are notoriously high (often 20–30%). Rewards only work in your favor when you’re buying things you would’ve purchased anyway.

2. Ignoring Category Bonuses

Not all spending is created equal. Many cards offer 2x, 3x, or even 5x points on specific categories like groceries, gas, or dining.

Rookie Mistake: Using a flat 1% card for everything.

Fix: Use the right card for the right purchase. Swipe your grocery card at the supermarket (like the Amex Gold) not your travel card. And if you’re trying to earn a welcome bonus focus your spending on that card until you hit the required amount.

Pro Tip:

If you hate juggling multiple cards and don’t want to play the “game”, a solid no-annual-fee card might be your best bet. The Chase Freedom Unlimited for example earns 1.5% cash back on all purchases and The Citi Double Cash earns 1% when you swipe and another 1% when you pay off the purchase for 2% cash back.

3. Letting Points Sit Too Long

Points can lose value over time or even expire and loyalty programs can also change without warning.

Rookie Mistake: Hoarding points “for a big trip someday” that never comes.

Fix: Have a redemption goal and use points regularly, especially for travel.

I get it. You heard about how you can travel around the world for free on points and now you’re sitting on a stash of points you haven’t touched in 5 years.

But here’s the deal: If you don’t have a plan, that stash can lose a ton of value either from devaluations or transfer partner changes. If you find solid redemption value even for a short(er) regional trip, don’t be afraid to use them.

And if you’re sitting on a pile of points you’ll likely have enough for your dream trip when the time comes (or can easily earn more).

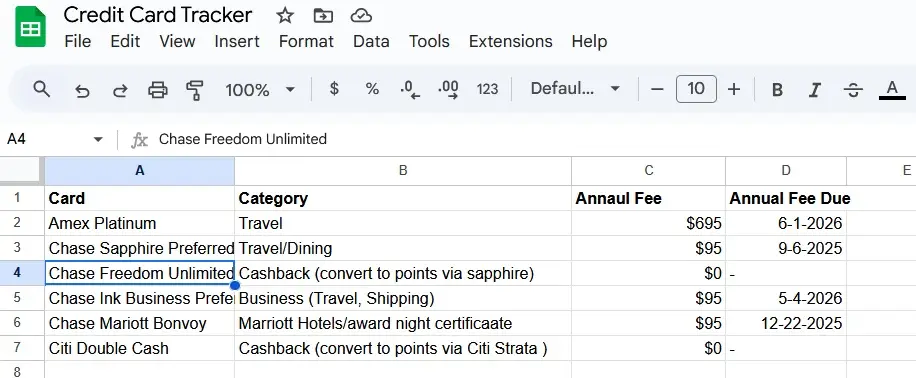

4. Not Tracking Your Cards or Annual Fees

As mentioned earlier many people use the wrong card at the wrong time or worse, they keep paying annual fees on cards they rarely use and/or are not getting enough value from.

Rookie Mistake: Leaving an annual-fee card in the drawer for 11 months.

Fix: Do a quarterly card audit. Cancel, downgrade, or shift your spending if a card no longer provides value.

Example:

I have the Marriott Bonvoy Card from Chase, which comes with a $95 annual fee. It mostly sits in my drawer but it provides me with one free hotel night per year. I haven’t seen a decent hotel room under $95 in years and if you do, check for blood stains on the mattress. So even with minimal use, I’m still getting outsized value from the card.

🛠 Tools like CardPointers (paid) or TravelFreely (free) can help you stay organized and optimize your strategy.

5. Redeeming Points for Weak Value

Not all points are worth the same. A $100 gift card might cost 15,000 points but a $100 flight might only cost 10,000.

Rookie Mistake: Redeeming points for gift cards or merchandise.

Fix: Always compare redemption values before cashing out. Partner transfers usually offer the best value. Travel portals and statement credits typically beat gift cards too.

Real Example:

Last fall, I booked a business class flight from JFK to London worth over $5,000 for 47,500 Amex points transferred to Virgin Atlantic. Those same points might’ve been worth $200–$500 max if I had redeemed them for gift cards. Big Difference

Final Word: Be Intentional

Credit card rewards can do real work for you but only if you’re strategic. If you’re collecting points with no plan or paying interest along the way, you’re not winning you’re subsidizing the banks.

Check out this earlier article here to see how I use some of my favorite credit cards in my everyday life.

Tired of missing out on points, and rewards?

I drop 1–2 quick reads each week on Smarter Investing, Credit Card Tips, & Building confident young investors.

Subscribe Below and I’ll send the next one straight to your inbox.